Have you ever wondered how long you can get away with keeping that aging Windows system your business relies on every day? For businesses in Willow Grove, PA, the dangers of outdated Windows systems pose more significant threats than just annoying freezes or slow performance. These hidden risks could be silently destroying your business security and jeopardizing your future success.

Why Are Outdated Windows Systems So Dangerous to Your Business?

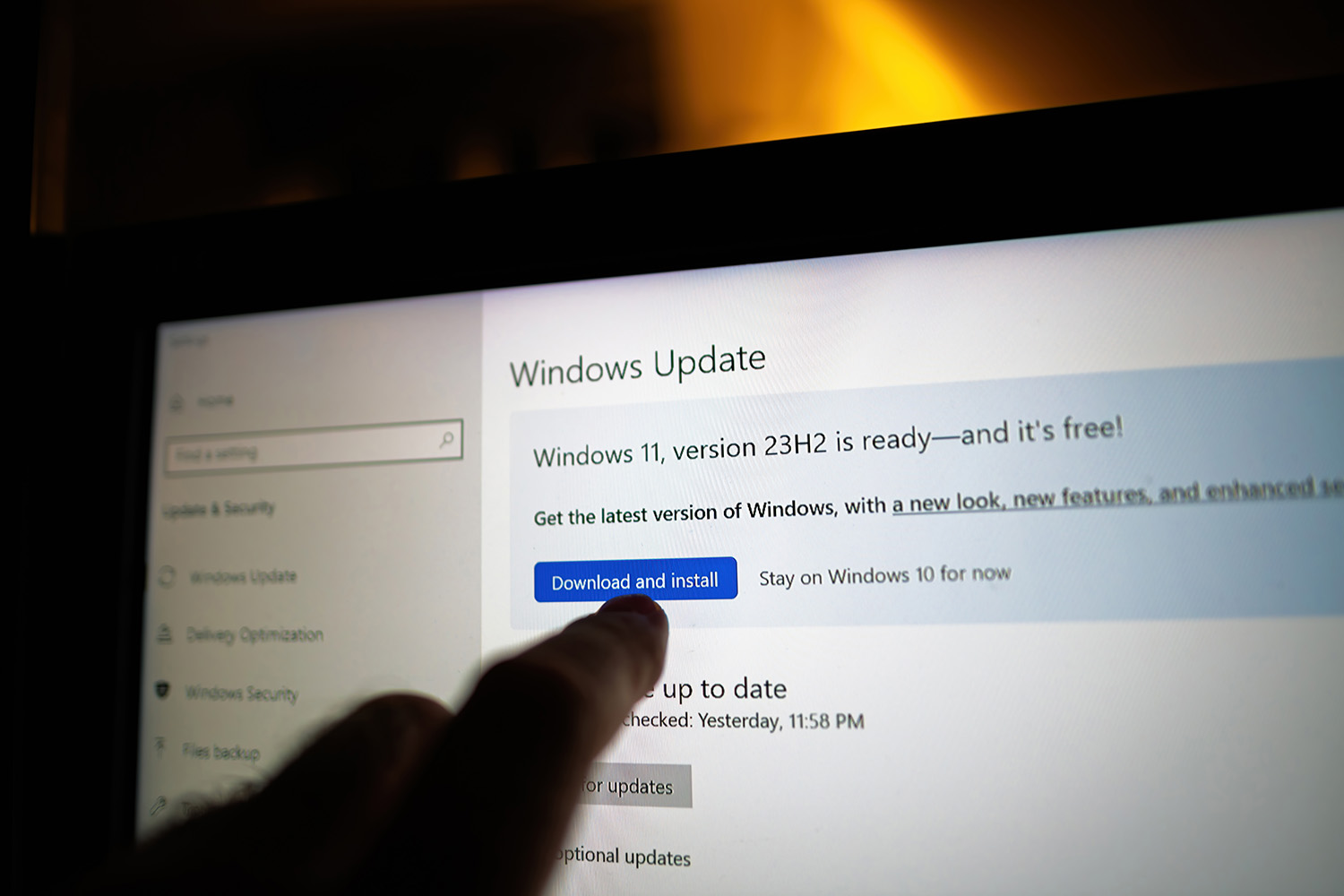

When did you last update your business systems? Operating systems can be costly, but if you’re running outdated versions like Windows 7, 8, or even older server editions, you’re making the work of cybercriminals much easier.

Outdated Windows systems do not receive security patches from Microsoft, which means that every newly discovered vulnerability in these systems will remain exploitable indefinitely. How would your customers react if they found out your company exposed their sensitive information in a preventable security hole?

In Willow Grove, local businesses are being increasingly targeted by cybercriminals specifically because they tend to have outdated systems that make for easy prey. Just last year, a local insurance company running Windows 7 lost access to its entire customer database in a ransomware attack that capitalized on a well-known vulnerability.

Can Using an Outdated Windows System Put You in Legal Trouble?

Are you subject to industry regulations like HIPAA, PCI DSS, or GDPR? Running an outdated Windows system could well put you in direct violation of these compliance requirements.

How much would a compliance violation cost your business in terms of fines and reputational damage? For many businesses in Willow Grove, the answer is “too much to risk.”

What Are the Hidden Operational Costs?

This isn’t just about security and compliance concerns. Outdated Windows systems can drain your resources in less obvious – but equally concerning – ways:

- How much productive time do your employees lose while they’re waiting for slow systems to respond?

- What happens when critical business applications stop supporting your outdated operating system?

- How quickly can you recover when your outdated system inevitably crashes?

Every aspect of your business operations can be impacted by running outdated Windows systems, from daily productivity to disaster recovery capabilities.

Stay Current, Stay Protected

Protecting your business doesn’t have to be overwhelming. The first step is understanding exactly where your vulnerabilities lie and what immediate risks you face.

Take Action Today on Outdated Windows Systems

Do you want to see exactly how vulnerable your business is right now? Our Internal System Audit Report provides a comprehensive assessment of your current Windows environment, identifying specific risks and outlining a clear upgrade path tailored to your business needs.

This detailed, personalized report shows you:

- Which systems pose immediate security risks

- Compliance gaps that could lead to penalties

- Operational inefficiencies costing you money daily

- Prioritized recommendations for system upgrades

Don’t wait for a breach or system failure to expose the dangers of running outdated Windows systems in your business. Contact us today to schedule your Internal System Audit Report and take the first step toward comprehensive protection for your Willow Grove business.

Your business deserves modern protection against modern threats. Let’s secure your future together.

Quick Questions Answered

- Is it dangerous to run Windows 7? → Yes, you’re exposed to constant vulnerabilities.

- Can outdated systems affect compliance? → Absolutely — HIPAA, PCI, GDPR all require secure systems.

- What should I do first? → Schedule a system audit tailored to your business.